do i need a tax attorney or cpa

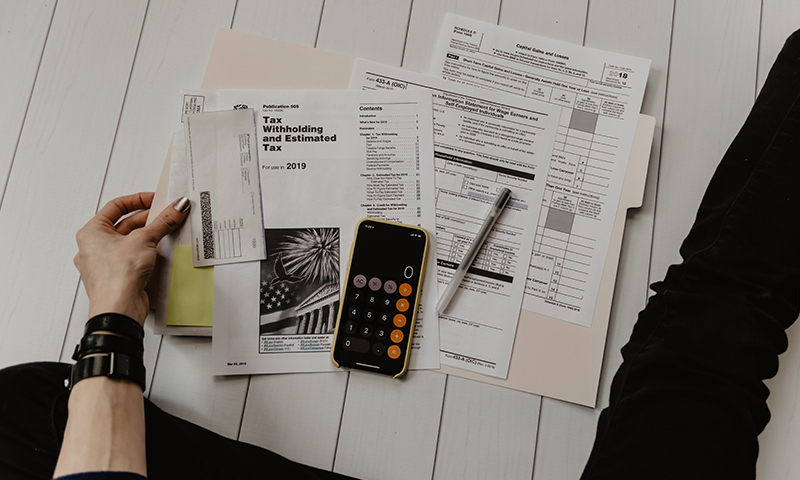

If you owe the IRS or the State of California at least 10000 call Sacramento Law Group LLP for a free tax consultation. Furthermore a tax attorney provides the advantage of attorney-client privilege.

Tax Attorney Vs Cpa What S The Difference Thestreet

For example if you are.

. Hiring a CPA can work if your tax case is short and confined to exchanging your tax documents with the IRS and assessing your returns and accounting concerns. If youre having trouble with the IRS an attorney can give you attorney-client. But if your LLC is investor-backed you should work with a CPA and a tax attorney.

Whether you need to hire a CPA or a tax attorney depends upon your tax needs. Both are important to keep you and your business out of trouble a CPA can prevent issues before they even happen by ensuring the right procedures are followed while a tax. Which Do You Need.

Finding the right person to fix your complicated tax situation can be tough so its important to understand the differences between a tax attorney CPA and an enrolled agent. There are several reasons why you might need a. You should most likely hire a CPA if you need help with the business and accounting side of taxes.

Cost wise youre probably better off just pay the 2k than. Do I need a CPA for my taxes. Tax Attorney vs.

Accounting firms are required to have the CPA review and sign. A CPA or certified public accountant is someone who specializes in taxes and can manage the math involved with them. All information you divulge to your tax lawyer is protected under the attorney-client privilege.

While Tax Attorney is better when dealing with IRS especially in criminal matters or tax evasion matters a CPA will be better when dealing with Financial Statement Audits. Here is why you should opt for a tax attorney over a CPA nonetheless. A CPA can help to strengthen a legal case especially if he or she helped to prepare the tax returns in question.

Your businesss CPA can also offer tax planning advice throughout the year to help minimize. Typically you want to hire a CPA if you have much money coming in and out because you can benefit more during the tax season. Cover all your bases by.

If you want to take the prevention approach while being ready for intervention a dually-certified tax attorney and CPA will support you from all angles. Your CPA may be required to be a witness against you but your tax attorney isnt. Most people dont need a CPA for their taxes.

They are legally responsible for signing off so they will review it. CPAs are an ideal business partner to have for day-to-day accounting and tax issues. In short a CPA.

Our Sacramento tax lawyer can help you resolve tax debt and get out of.

Iam1428 Attorney And Cpa Helps Businesses With State Tax Problems I Am Ceo Podcast

Cpa Vs Tax Attorney Tax Attorney Cpa Michael J Krus

Do I Need To Hire A Tax Attorney Or Cpa To Represent Me In An Irs Tax Audit Yqa 206 2 Youtube

Enrolled Agent Vs Cpa Vs Tax Attorney Cross Law Group

Do I Need A Tax Attorney Or Cpa Laws101 Com

Cpa Vs Lawyer Top 10 Best Differences With Infographics

When You Need A Tax Attorney In Georgia

Why You Want A Tax Attorney To Help You With A Tax Problem Instead Of Or In Addition To A Cpa Or Tax Service

Three Reasons Why An Attorney Cpa Is Better Than A Cpa

Do You Need A Tax Attorney Or Cpa

Do I Need A Tax Attorney Or Cpa Laws101 Com

Choosing A Tax Attorney Cpa Or Enrolled Agent Rocket Lawyer

Cpa 5 Reasons To Hire An Accountant To Do Your Taxes

Nyc And Albany Ny Tax Attorney Cpa Blog Nyc Albany Ny Irs Lawyer Tax Resolution Tax Help Irs Tax Audit Fbar Attorney Tax Law Firm

Top Reasons Why You Should Hire A Tax Attorney

Cpa Enrolled Agent Tax Attorney Which Do I Need Njmoneyhelp Com

New York Tax Attorney Peter E Alizio Cpa Esq

Law Offices Of Lawrence Israeloff Pllc Tax Attorney Cpa

Tax Attorney Alternative Munoz Company Cpa Tampa Fl 813 425 1916